How Auto Insurance Helps You Stay Secure on the Road

Driving Securely: How to Select the Finest Auto Insurance for Your Requirements

Browsing the complexities of vehicle insurance coverage can often really feel frustrating, yet it is an essential facet of accountable lorry ownership - auto insurance. Recognizing the fundamentals of insurance coverage types and assessing your private demands are vital very first steps in making an educated selection. Additionally, assessing and contrasting numerous policies insurance suppliers can considerably influence both your economic safety and security and comfort. Nonetheless, the question continues to be: what specific techniques can you utilize to make certain that you secure the most appropriate protection at the very best possible rate?

Comprehending Automobile Insurance Coverage Basics

Auto insurance policy is a critical component of lorry possession, supplying monetary defense versus different risks associated with driving. This crucial insurance coverage safeguards motorists from prospective obligations developing from mishaps, theft, or damages to their cars. Understanding the principles of automobile insurance coverage is important for making informed choices relating to plan choice.

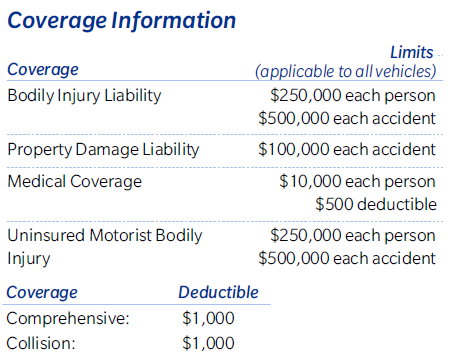

At its core, auto insurance coverage typically consists of a number of vital components, including obligation insurance coverage, collision coverage, and detailed insurance coverage. Collision coverage, on the various other hand, helps pay for fixings to your very own vehicle complying with a mishap, no matter of mistake.

Furthermore, lots of plans might offer optional coverages, such as uninsured/underinsured driver security and individual injury protection. Understanding these fundamental elements can equip consumers to navigate the insurance coverage landscape better, ensuring they select a policy that straightens with their demands and way of living.

Examining Your Protection Requirements

When figuring out the ideal automobile insurance coverage, it is vital to analyze your insurance coverage requires based upon your individual circumstances and driving behaviors. Begin by evaluating your vehicle's worth; more recent or a lot more costly automobiles generally necessitate extensive and accident coverage to protect versus prospective losses. Conversely, older vehicles might only require liability insurance if their market price is reduced.

Next, consider your driving patterns - auto insurance. A robust responsibility policy is important to protect versus mishaps if you frequently drive in high-traffic locations or have a long commute. Examine your danger variables, such as your driving background and any type of previous claims, as these can affect the coverage degrees you may require

Additionally, review your financial scenario. Higher deductibles can decrease premium costs yet may bring about greater out-of-pocket expenditures in the event of a claim. It is sensible to strike a balance between economical costs and sufficient insurance coverage to mitigate monetary threats.

Finally, contemplate any type of lawful requirements in your state, as minimum insurance coverage limits can vary. Completely assessing these variables will certainly empower you to make educated choices customized to your unique requirements, guaranteeing you pick one of the most appropriate car insurance coverage plan.

Contrasting Policy Options

An extensive strategy to contrasting policy choices is essential for securing the most effective car insurance policy protection. Begin by recognizing the kinds of coverage offered, such as liability, collision, extensive, and uninsured/underinsured driver protection. Each type serves various functions, and comprehending these can assist customize a plan to satisfy your certain demands.

In addition, take into consideration any kind of optional attachments such as roadside aid, rental cars and truck repayment, or gap insurance. These additionals can improve your coverage however may also increase your discover this premium.

Collect quotes from numerous insurance firms to make certain a detailed contrast. Online tools and insurance representatives can facilitate this procedure, giving understandings right into price variants and policy features. Assess the problems and terms thoroughly, as fine print can reveal vital details pertaining to exclusions or constraints that could influence your coverage. By taking these actions, you can make an informed decision on the plan that best fits your requirements.

Evaluating Insurance Coverage Providers

Choosing the ideal auto insurance coverage is only component of the formula; the reputation and reliability of the insurance coverage copyright play a significant function in your general experience. To guarantee you pick a credible copyright, start by investigating their financial stability. auto insurance. A strong financial score from companies such as A.M. Finest or Requirement & Poor's shows that the company can satisfy its responsibilities during insurance claims

Next, think about the supplier's customer care performance history. On-line testimonials, testimonials, and ratings on platforms like the Bbb can offer insights right into just how well they take care of cases and consumer queries. When you need assistance., a responsive and courteous client service team can make a substantial distinction.

Furthermore, assess the insurance claims process. A straightforward, clear insurance claims procedure is essential for minimizing stress and anxiety throughout unfortunate occasions. Try to find providers that offer numerous channels for submitting insurance claims, such as mobile apps, on-line portals, or phone assistance.

Tips for Decreasing Premiums

Finding means to lower your vehicle insurance coverage premiums can considerably impact your general budget without giving up protection. Applying a few calculated measures can result in significant savings.

Maintaining a clean driving record is crucial. Preventing crashes and traffic violations can qualify you for risk-free motorist discount rates. Numerous insurance providers provide discounts for low gas mileage, so take into consideration car pool or utilizing public transportation to decrease your yearly mileage.

Evaluating your coverage periodically is her explanation essential. As your vehicle ages, you might not require extensive or collision coverage. Review your plan to ensure it Get the facts aligns with your existing requirements.

Last but not least, take benefit of offered discounts. These might consist of good pupil discount rates, military discounts, or subscription discount rates via specialist organizations. By using these suggestions, you can effectively lower your premiums while guaranteeing you remain properly covered.

Verdict

In verdict, picking the most ideal auto insurance requires a detailed evaluation of individual coverage needs, monetary situations, and risk factors. Carrying out strategies to reduce premiums can improve cost while preserving appropriate insurance coverage.

At its core, vehicle insurance policy typically is composed of numerous vital parts, consisting of responsibility protection, accident protection, and extensive coverage.When establishing the right vehicle insurance coverage plan, it is vital to examine your protection needs based on your individual circumstances and driving habits.A thorough strategy to contrasting policy options is essential for safeguarding the finest auto insurance policy protection. Furthermore, bundling your automobile insurance coverage with other plans, such as renters or home owners insurance coverage, can frequently generate price cuts.

In conclusion, selecting the most ideal car insurance requires an extensive analysis of private coverage demands, financial conditions, and risk aspects.